ABOUT

24 Years. No investor capital losses.

Private investing, done personally.

Why investors are moving beyond Wall Street

Traditional wealth management relies on cookie-cutter portfolios designed for scale, not for you.

In volatile markets, these models expose investors to unnecessary risk while limiting access to opportunities that institutions quietly enjoy. At Ballard Global, we built a different approach. For 24 years, we have invested our own capital alongside our clients — and across every market cycle, we have never lost a single dollar of investor principal.

Private markets

with a personal approach

Every investor has different goals, timelines, and income needs. That’s why our strategies start with you.

Whether you want predictable income, tax-efficient growth, or diversification beyond Wall Street, we structure offerings with shorter terms, fixed returns, and capital alignment. You’re not just a line item on a spreadsheet — your portfolio reflects your vision.

Private investing, done personally. That's Ballard Global.

What sets Ballard Global apart

Institutional-grade access

Investments once reserved for endowments and family offices, now available to accredited individual investors.

Boutique experience, institutional rigor

Personalized relationships supported by proprietary analytics and disciplined underwriting.

Alignment of capital

We place our own funds first, then invite clients to participate alongside us.

Unmatched track record

24 years of managing private investments without investor capital loss.

Why now?

Markets have changed:

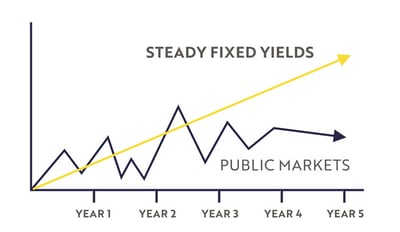

Inflation and volatility undermine Wall Street’s 60/40 model. Private credit and alternatives provide resilience and consistency.

Institutions already shifted:

Endowments and family offices allocate more than 30% of portfolios to private markets. Individual investors who wait risk falling behind.

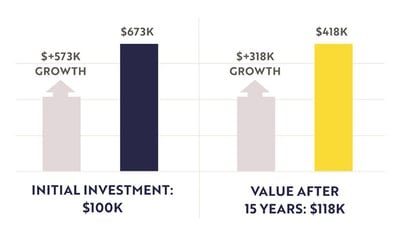

Time compounds value:

The earlier you access fixed yields, the greater the effect of compounding and tax-deferral. Waiting means missed years of growth.

Access has opened:

Until recently, private markets were closed to most. Today, Ballard Global provides individual investors direct access, with structures designed around their needs.

Where your capital fuels growth.

The Ballard Global difference

Ballard Global exists for investors who expect more.

We deliver institutional-grade opportunities with the care of a boutique firm.

Our record is over two decades of protecting capital while creating access for individuals who want to move beyond Wall Street.

If you want a partner that treats your wealth personally, invests alongside you, and delivers stability through every cycle — you’ve found it.